Ace Tips About How To Avoid Paying Income Tax

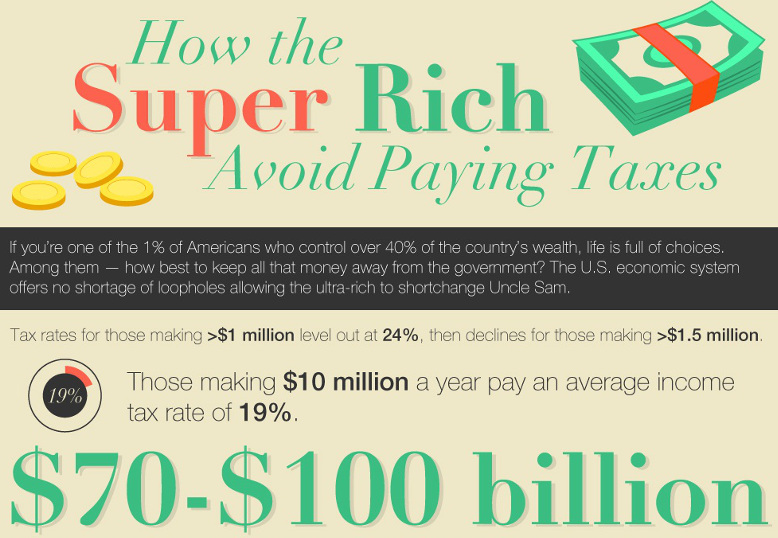

The internal revenue service (irs) allows for a variety of options, all with the potential benefit of sheltering income from taxes.

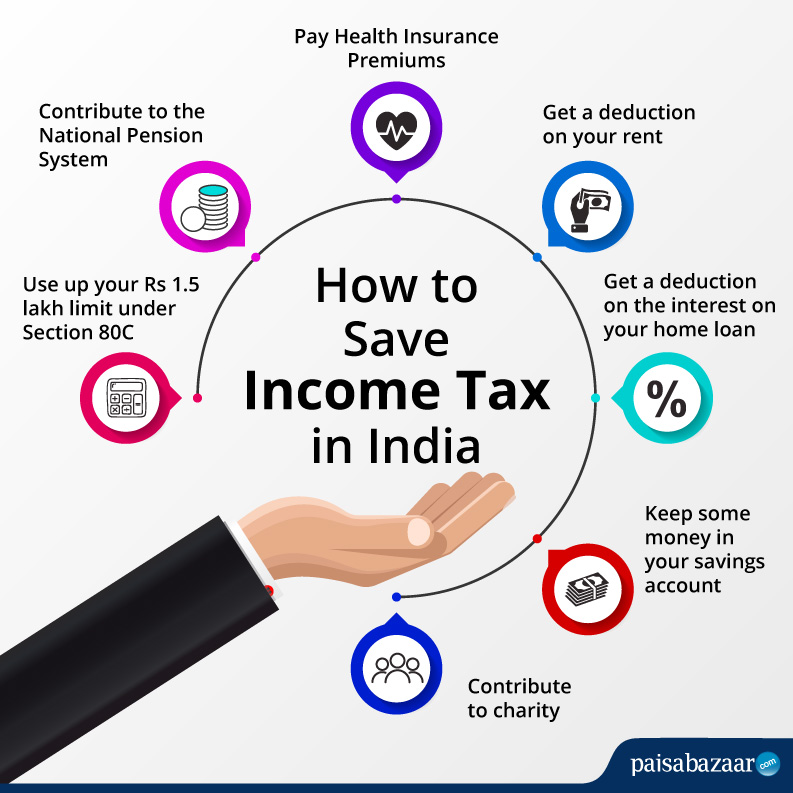

How to avoid paying income tax. To avoid or at least minimize failure to pay penalties, pay your tax in full by the tax deadline, even if you request an extension. Meet one of two additional criteria. Another fortune 500 and other major companies avoid taxes is with accelerated depreciation.

Ira taxes can be minimized ira taxes through roth conversion. If you owe more than you can afford to pay, pay as. How do small businesses avoid paying taxes?

Spread payments over time to avoid higher taxes: There are other strategies that can help you avoid paying taxes on ira withdrawals, some of which might fly under the radar. To avoid paying taxes on your annuity, you may want to consider a roth 401(k) or a roth ira as a funding source.

Withholding from your pay, your pension or certain government payments, such as social security. In 2022, the feie allows individuals to exclude up to $112,000 or $224,000 for married couples filing jointly. Contribute to a retirement account 4.

If your contribution exceeds the $100,000 per year limit, you can carry it forward for up to five years. Money that you pull from your traditional ira or traditional 401 (k) will count as income in the year that you withdraw it. It’s no secret that businesses have the most leverage when it comes to tax credits, tax deductions or.

One of the best ways to reduce taxes for your small business is by hiring a family member. 11.7 million dollars in tax free wealth translates to a damn lot of rolex watches. You can even hire your children.

.jpg?width=560&name=Scott%20Boyar%20Graphics%20(11).jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)