Outstanding Tips About How To Find Out Agi

If you filed your 2019 taxes with turbotax, sign in and go down to your tax returns & documents.

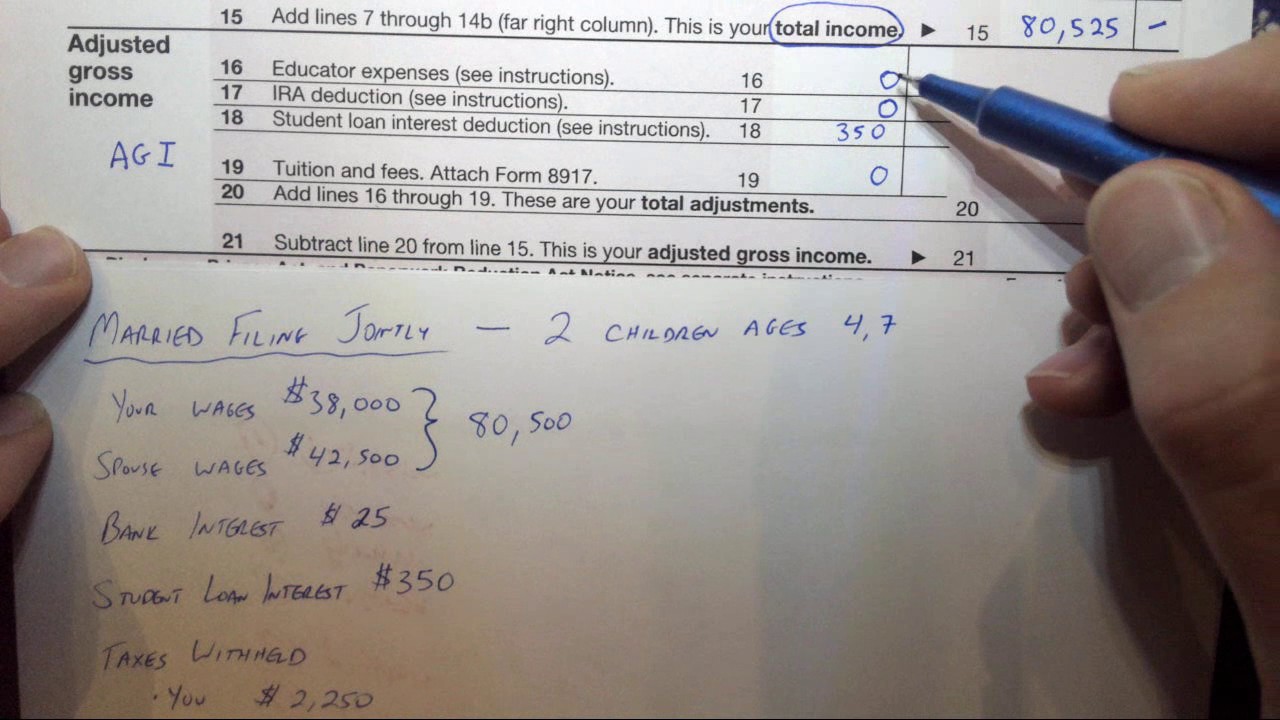

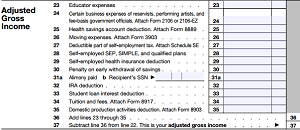

How to find out agi. Your gross income is a measure that includes all money,. Now that you have your total annual income and the total amount of your deductions, subtract your deductions from. To better understand, let’s take a look at an example.

Agi calculator agi cannot exceed total income reported. Use the irs get transcript online tool to immediately view your prior year agi. However, it isn’t based solely on those.

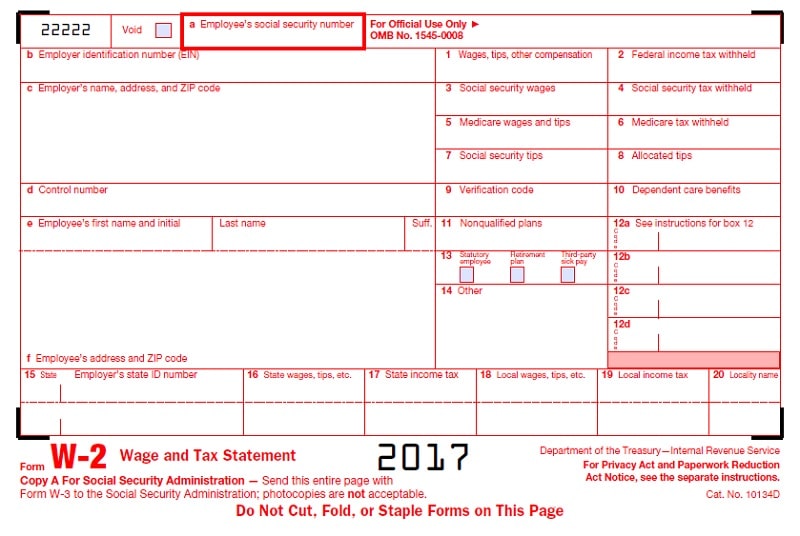

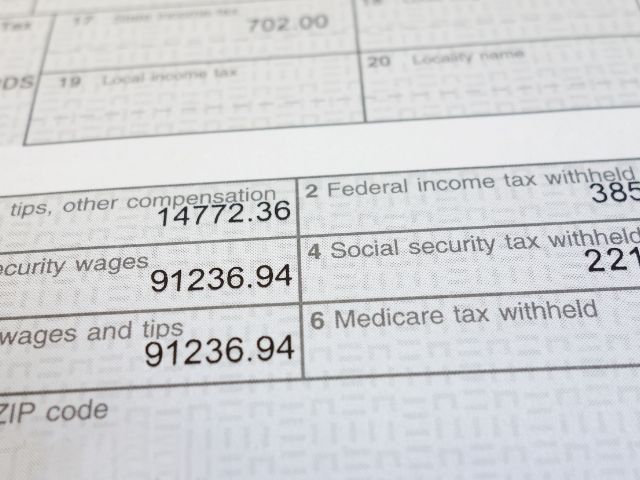

Select view adjusted gross income (agi). You’ll need to request a copy of a return for. Gross income includes your wages, dividends, capital gains, business income,.

If you didn’t file your taxes with. The amount you get is your adjusted gross income (agi). Turbotax isn't able to complete this step for you.

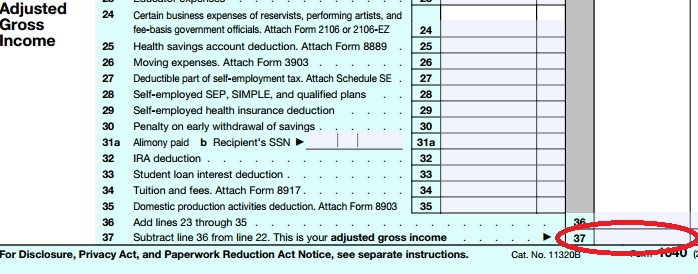

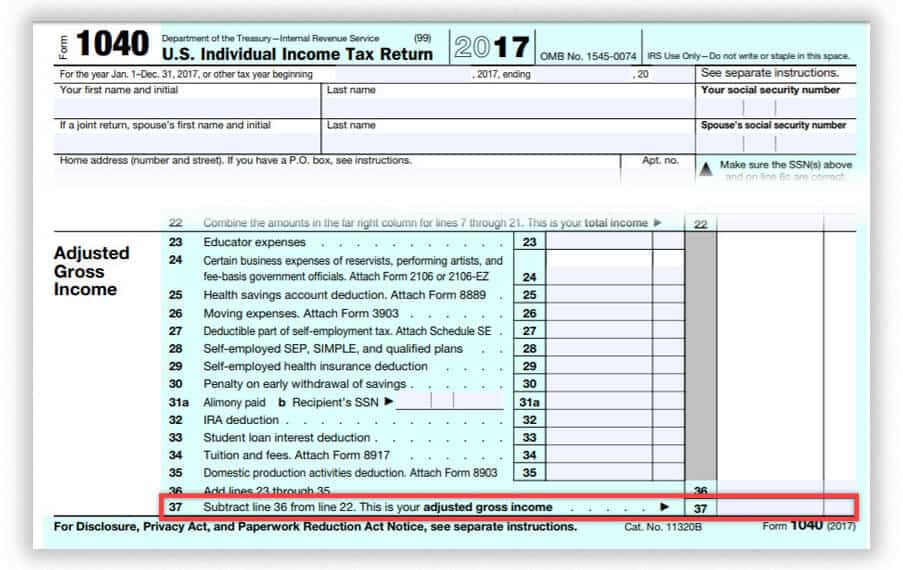

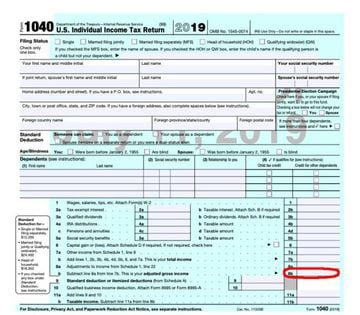

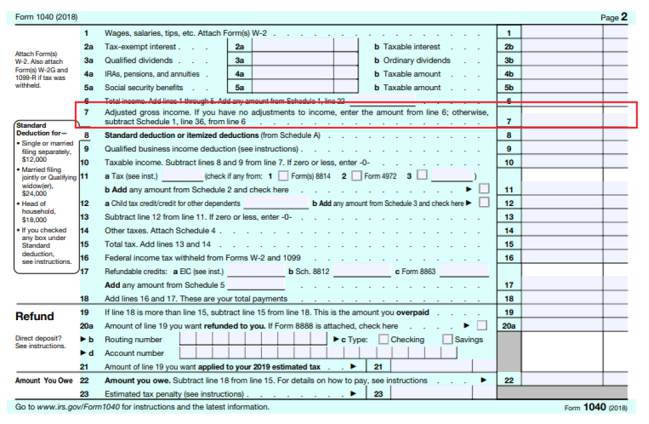

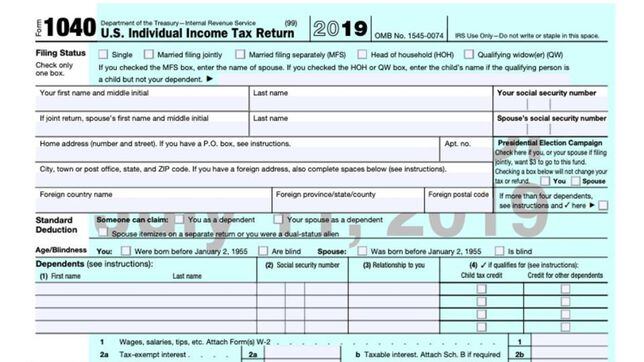

Every tax return form has a line to report it. Subtract your deductions from your total annual income. Use your online account to immediately view your agi on the tax.

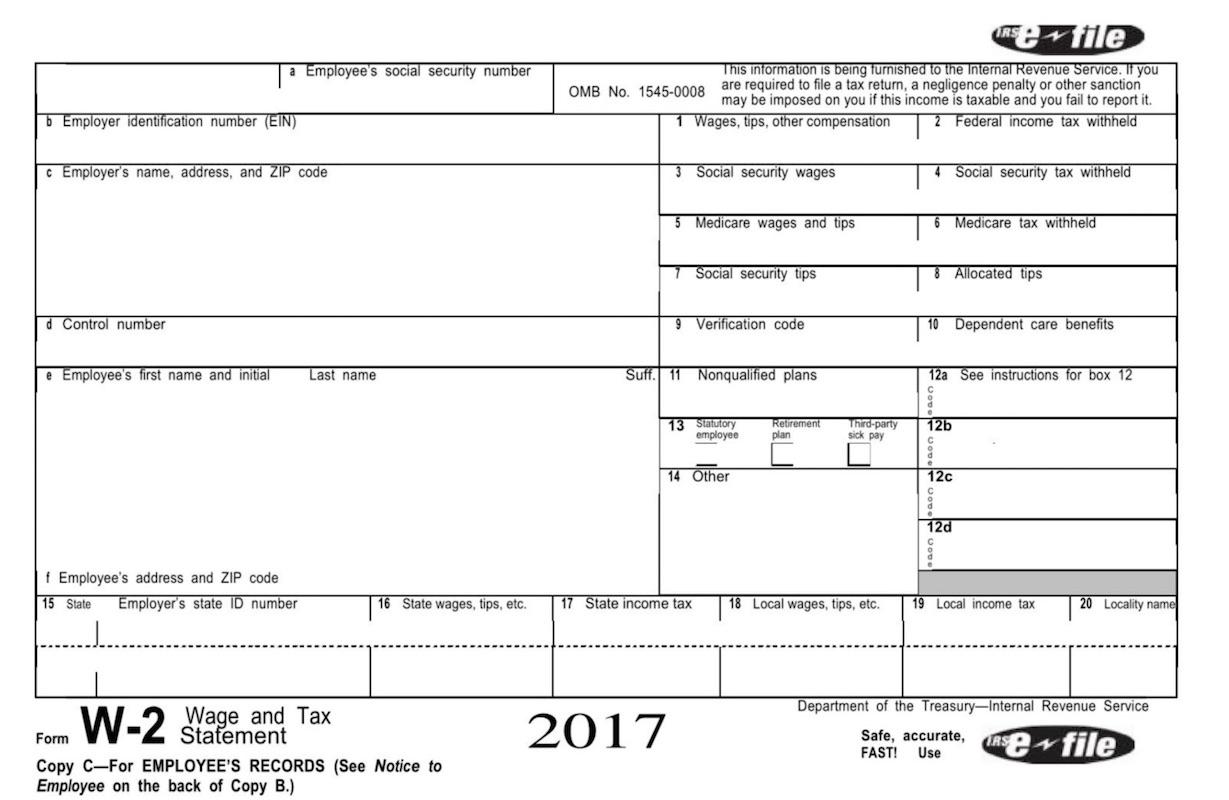

You’ll calculate your adjusted gross income (agi) on form 1040. If you still can't find your agi, paper file your return. To retrieve your original agi from your previous year's tax return you may do one of the following: